Daily Settlement

Daily Settlement

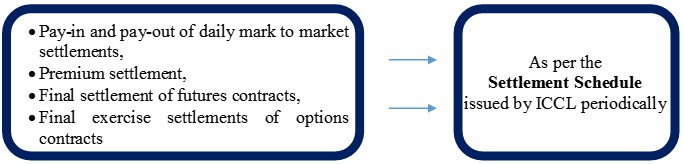

The daily mark-to-market settlement and premium settlement of currency derivatives contracts would be cash settled on T+1 day basis as per the timelines specified by ICCL.

Final Settlement

Final Settlement

| Currency Futures and Option contracts |

T+2 basis* |

| 91 Day GOI T-Bills and Cash settled Interest Rate Futures on 6/10/13 year G-Sec |

T+1 basis** |

| Cross Currency Futures and Option contracts |

T+2 basis*** |

| USDINR Weekly Derivative contracts |

T+2 basis**** |

|

* The Currency derivatives contracts would expire on the last working day (Two working days prior to the last business day of the expiry month at 12:30 pm.) of the contract month. The final settlement date shall be T+2 day from the last trading day of the contract as specified by the Exchange, as per the timelines specified by ICCL.

** The final settlement date shall be T+1 day from the last trading day of the contract as specified by the Exchange, as per the timelines specified by ICCL.

*** The Cross currency derivatives contracts would expire on the last working day (Two working days prior to the last business day of the expiry month at 12:30 pm.) of the contract month. The Final Settlement will be on T+2 day basis as per the timelines specified by ICCL.

**** The USDINR Weekly derivative contracts will expire on every Friday of the week except for the expiry week of monthly contract. In case the Friday is a trading holiday, the previous trading day will be the expiry/last trading day. All weekly contracts will expire at 12:30 p.m. (RBI Reference Rate Time) on the expiry day or such other time as decided by the Exchange